So you’ve decided you want to invest in crypto. Well, there are some very important considerations to make before jumping right in. Here are 6 considerations to keep in mind before you purchase any crypto.

This guide is about medium to long term value investing, not speculating on meme coins or flavor of the week tokens. The content we aim to provide is about value and growth over longer time frames to bring credibility and quality to crypto-analysis and investing.

Are You Trading or Investing

Decide whether you’re an investor or a trader? While these terms are often (incorrectly) used interchangeably, they are very different approaches. How you view and interact with an asset is very difficult depending on your role and each requires different skills and mind-set.

Investors buy an asset to hold it because they believe the value will go up over time as a result of the team involved, dividends it can generate, market it can capture, or a variety of different reasons. They use fundamental analysis (FA) to evaluate an asset and buy for its future potential. Investors do not frequently buy and sell the asset. Investing is a more passive approach with a longer time frame.

Traders on the other hand do not have to care at all about the success or failure of a business or asset in the future. They care about timing the market and making money. Traders often use technical analysis (TA) and macro trends to determine their entries and exits in a given asset. Trading is an active approach with often shorter time frames.

You can do both, but it takes discipline and you must be clear which role you’re playing at any given time.

Investment time horizon

Your investment time horizon is a very important point in all investing strategies from traditional finance to crypto. You should determine how long you want to be invested for, sometimes that’s a time frame other times it may be a specific price target. It’s better to have a longer time horizon with investing especially if you’ve done the research and understand the value.

However, everyone has different financial goals whether it’s buying a house in 10 years, retiring in 30, or a nice vacation next year. If you make a significant investment in an asset expecting it to go up right away you may become disappointed if it actually goes down or stays flat for some time. Set your expectations and don’t risk money you can’t afford to lose or will need in the near term.

Research

This may very well be the most important part of your journey into investing in crypto. With traditional investing and stocks/equities you have reputable analysts writing in-depth research into Tesla, Microsoft, APPLE etc. These companies are publicly traded and have been evaluated and vetted by banks, national exchanges (like the Toronto Stock Exchange), and various securities commissions prior to being made available for investors to purchase.

Additionally, you have investment advisors and wealth managers that can give you tips or criteria on how they evaluate investment opportunities. In crypto it is still very much the wild west. There are several websites, YouTube channels, subreddits etc. but it’s difficult to find reliable, unbiased, and credible research on the many investment opportunities out there.

We have developed a robust criteria that you can use to checklist potential investments and see how they match up. LINK

Diversify

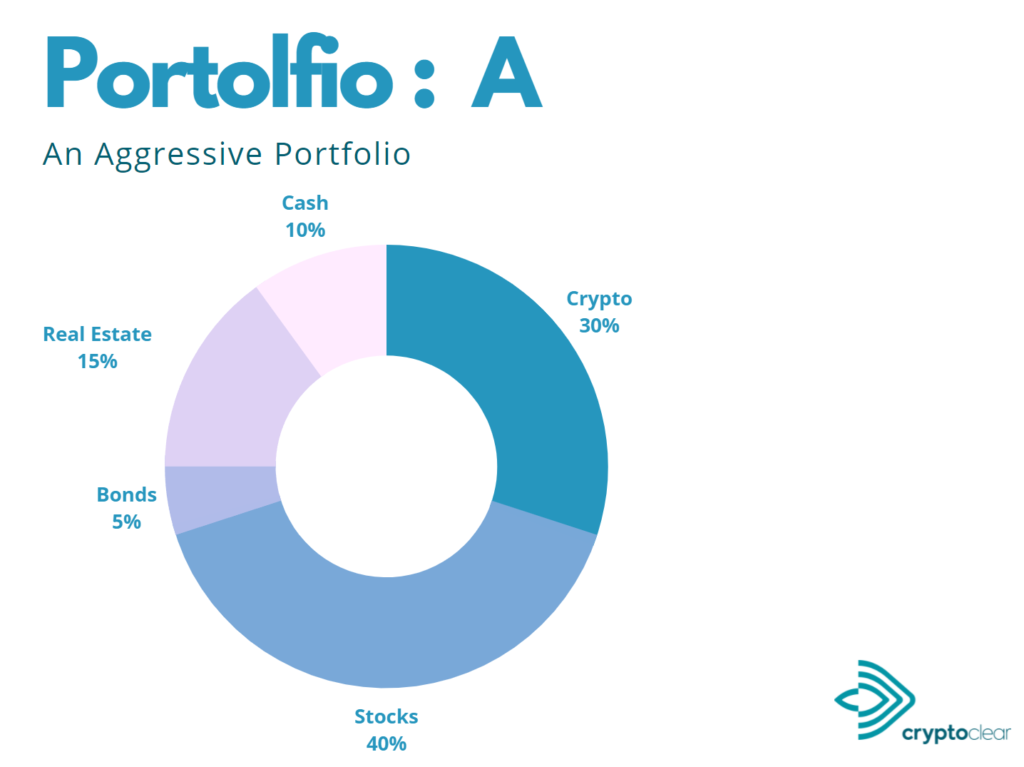

If you’re only invested in bitcoin and Ethereum diversification may not be necessary, however that’s assuming you have a balanced portfolio outside of cryptocurrencies. If you don’t have cash savings and stocks or bonds, then investing heavily in cryptocurrencies is likely not a good idea. Cryptocurrency investments should be a part of a complete and balanced portfolio.

Crypto is a more mature industry now than it once was. There are several ways to be diversified within the crypto space itself. For most new crypto investors bitcoin and ethereum are safe investments as boring as that may seem. Every other cryptocurrency is riskier and more volatile. The best way to learn and in-turn diversify your holdings is by using different blockchains and apps. A few crypto ‘eco-systems’ you may want to look into are Terra Luna, Cosmos, Avalanche, and Solana. These each have their own native token that you can invest in (LUNA, ATOM, AVAX, and SOL respectively).

Across all these different crypto ecosystems there are niches to explore and invest in. For example, infrastructure could be an investment niche where you look into components like node operators (INFURA), mining/staking (LIDO), or oracles (LINK) for different blockchains. Money, where crypto all started, is another niche, including assets like BTC, XMR, XRP, ZCASH, and LTC. Two other segments, both which have seen explosive growth recently are NFTs (BAYC, Punks, AZUKI) and Gaming (DFK, MANA, AXIE).

Starting small is a good strategy. Don’t rush into any investment and do consider the different ways you’re diversified, before and after your investment.

If you want to learn more about crypto niches and sector for investment —-Article on different categories

Entry Plan

Having a plan will help you get results. This whole guide is a basic framework for an investment plan, but your purchasing strategy should also be thought about in detail. always make achieving your desired result easier. Don’t get overly excited and just jump in. We’ve spoken to far too many people who “bought at the top” or just felt they could have timed it better. Timing the market is hard, time in the market is easier. If you stick to a plan you can be less emotional about it and let it run its course.

The best entry strategy for beginners in crypto is dollar-cost averaging (DCA). Dollar cost averaging is simply breaking up your investment into pieces over a certain timeframe. For example, if you wanted to invest $1000 into Bitcoin using a DCA strategy you could invest $50/week over 5 months. DCA’ing into a position mitigates the negative impact of volatility and significantly reduces the stress associated with price movement. If the price drops significantly in week 2 you’re able to purchase more bitcoin than in week one with the same amount of money lowering your average cost.

DCA consists of 3 simple variables:

- How Much? (ex. $50)

- How Often? (Once Per Week)

- For How Long? (6 months)

Having an entry plan makes investing more simple and less stressful. As crypto matures and decouples from the stock market, timing the market will become even more difficult.

Exit Plan

Whether it’s 3 months, a year, or a few decades, you should have an exit strategy. This can be a dollar amount, percent gain, or a time-frame. It’s easier said than done. When prices are rising and there is euphoria within the bull-market it can be difficult to get in touch with reality. The reality distortion field of bull markets can get so bad that any comment or post online hinting at signs of slowing down or locking in some gains are attacked. You haven’t realized any profits until you sell.

The psychology around investing is really quite interesting. Hindsight is always 20/20. One of the most common conversations for new investors in crypto surrounds timing: “I should have held longer!” “I should have sold when it was…” Having a good plan makes you less emotional and that makes you a better investor.

It can be as simple as setting a few price targets and selling a bit each time one hits. For example, you may sell 25% of your BTC holdings when the price hits $100,000 price and another 30% at $150,000 and hold onto the rest for 2 years then reevaluate at that time.

This applies with poor investments too. Not every investment is a great one and it pays to know when to cut your bad ones and quickly. Changes in the macro environment such as wars, world economics, or advancements in technology can temporarily affect or completely invalidate one’s original investment thesis. Your investment time horizon is closely tied to your exit plan – a shorter time horizon requires a more aggressive and disciplined exit plan.

Having a good exit plan will help you avoid getting trapped because remember, gains aren’t gains until you sell.

💸💸💸

We are not financial advisors nor a financial institution. This content is produced and distributed for education and information purposes only. Crypto is risky and speculative in nature. Please do your own research (DYOR) before investing.